how to file mortgage on taxes

For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions. Prep E-File with Online IRS Tax Forms.

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

Scan document into PDF.

. Therefore if one of you paid alone from your own account that. Ad From Simple to Advanced Income Taxes. Pay any taxes or fees by eCheck and.

To start your application for those deductions click here. The 1098 has multiple. Use Form 1098 to report mortgage interest of 600 or more received by you from an individual including a sole proprietor.

Please note that the property address entry field will auto populate. Create the tax forms. Now for those new to the mortgage credit certificate program its essential.

Free Case Review Begin Online. The first thing you need to know is that interest paid on mortgages is usually deductible from your income provided you itemize deductions rather than choosing standard. Create a cover page.

Filing tax deductions could result in significant savings even if you do not have a mortgage on your home. As a general rule your mortgage only impacts your taxes if you. Ad See If You Qualify For IRS Fresh Start Program.

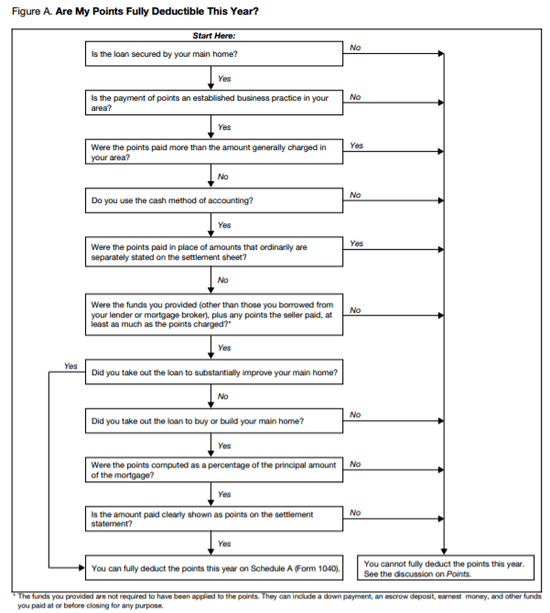

This is your Mortgage Interest Statement and it tells you exactly how. If you paid mortgage points and youve determined that you qualify for a tax break deducting them is pretty straightforward. If you have unfiled returns unpaid taxes or a tax lien you should contact a tax pro to help you.

Use Form 1098 Info Copy Only to report mortgage interest of 600. For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. Input the amount of home mortgage interest shown on your Form 1098 Box 1 deductible mortgage interest and input into line 8a of your Form 1040.

Quickly Prepare and File Your 2022 Tax Return. They can help you file. Get Help Applying for a Mortgage When You Have Unfiled Returns.

Your mortgage lender will send you a document called Form 1098 at the beginning of each new tax year. Refinancing may or may not affect your taxes depending on what type of refinance you used and how you file. Mortgage tax is to be rounded UP to the next highest 10000 on a fraction thereof.

Your loan servicer should also provide this tax. You should receive Form 1098 the Mortgage Interest Statement from your mortgage lender after the close of the tax year typically in January. Help Filing Your Past Due Return.

Since mortgage interest is an itemized deduction youll use Schedule A Form 1040 which is an itemized tax form in addition to the standard 1040 form. You can itemize or you can claim the standard deduction but you cant do both. As you begin to type a property location addresses will appear below.

Ad Browse Discover Thousands of Law Book Titles for Less. When claiming married filing separately mortgage interest would be claimed by the person who made the payment. Hendricks County currently allows for the Homestead and Mortgage deductions to be applied for online.

Review what you have uploaded. After completing the mortgage credit certificate tax form Form 8396 its time to submit your taxes. This form reports the total.

MORTGAGE TAX is 15 per 10000 or 150 per 100000 of amount financed. Based On Circumstances You May Already Qualify For Tax Relief. In order to be applicable to the next tax bill you must file for the desired tax.

If you need wage and income information to help prepare a past due return. Enter your mortgage interest costs on lines 8 through 8c of Schedule A then transfer the total. How to Deduct Mortgage Points on Your Taxes.

The interest on an additional 100000 of. Your mortgage lender should send you an IRS 1098 tax form which reports the amount of interest you paid during the tax year.

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

What Can You Write Off For Taxes With A Mortgage

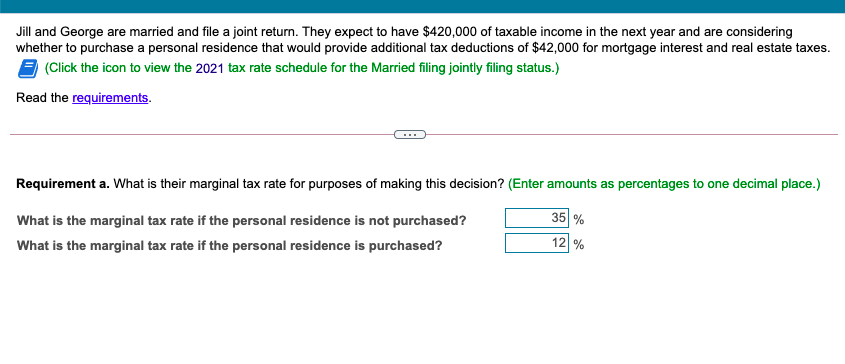

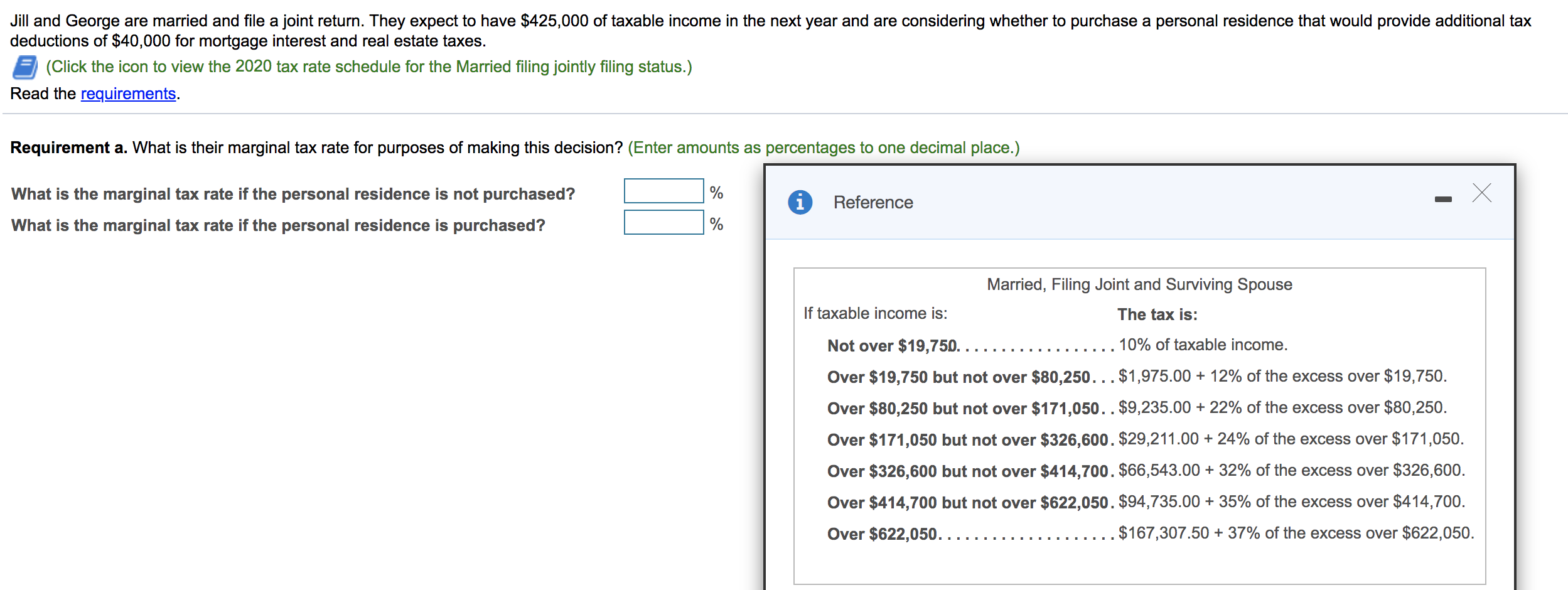

Solved Jill And George Are Married And File A Joint Return Chegg Com

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Mortgage Interest Not Showing On Schedule A

How To Claim The Home Office Deduction With Form 8829 Ask Gusto

Coming Home To Tax Benefits Windermere Real Estate

Does Buying A House Help With Taxes Rocket Mortgage

How To Qualify For A Mortgage With Unfiled Tax Returns

Your 1098 E And Your Student Loan Tax Information

Cash Out Mortgage Refinance Tax Implications Bankrate

Are Personal Loans Tax Deductible Common Faqs

Solved Jill And George Are Married And File A Joint Return Chegg Com

Taxes For Homeowners What You Need To Know Before Filing Your 2021 Return

How To Deduct Mortgage Points On Your Tax Return Turbotax Tax Tips Videos

Form 11 Mortgage Interest Deduction Understand The Background Of Form 11 Mortgage Interest D Irs Tax Forms Mortgage Interest Irs Taxes

Understanding The Mortgage Interest Deduction The Official Blog Of Taxslayer